Blue Sky Uranium (TSXV: BSK; US-OTC: BKUCF), a Vancouver-based uranium and vanadium explorer with 4,000 sq. km of prospective tenements in Argentina’s Patagonia region, expects to update the preliminary economic assessment for its Ivana deposit after completing an enhanced regional exploration drilling program next year.

Despite a difficult market for capital raising, Blue Sky announced on Dec. 2 the closure of the first tranche of a non-brokered private placement that netted $1.7 million in financing for exploration programs in Argentina and working capital. An earlier private placement financing in June raised $2.1 million for the firm.

“The market is tough out there overall, but there are bright spots,” says Nikolaos Cacos, president and CEO of the junior explorer. “Clean energy is one of them and there’s definitely a lot of interest in uranium. We’re looking to ensure we have enough funds to complete drilling at our new targets.”

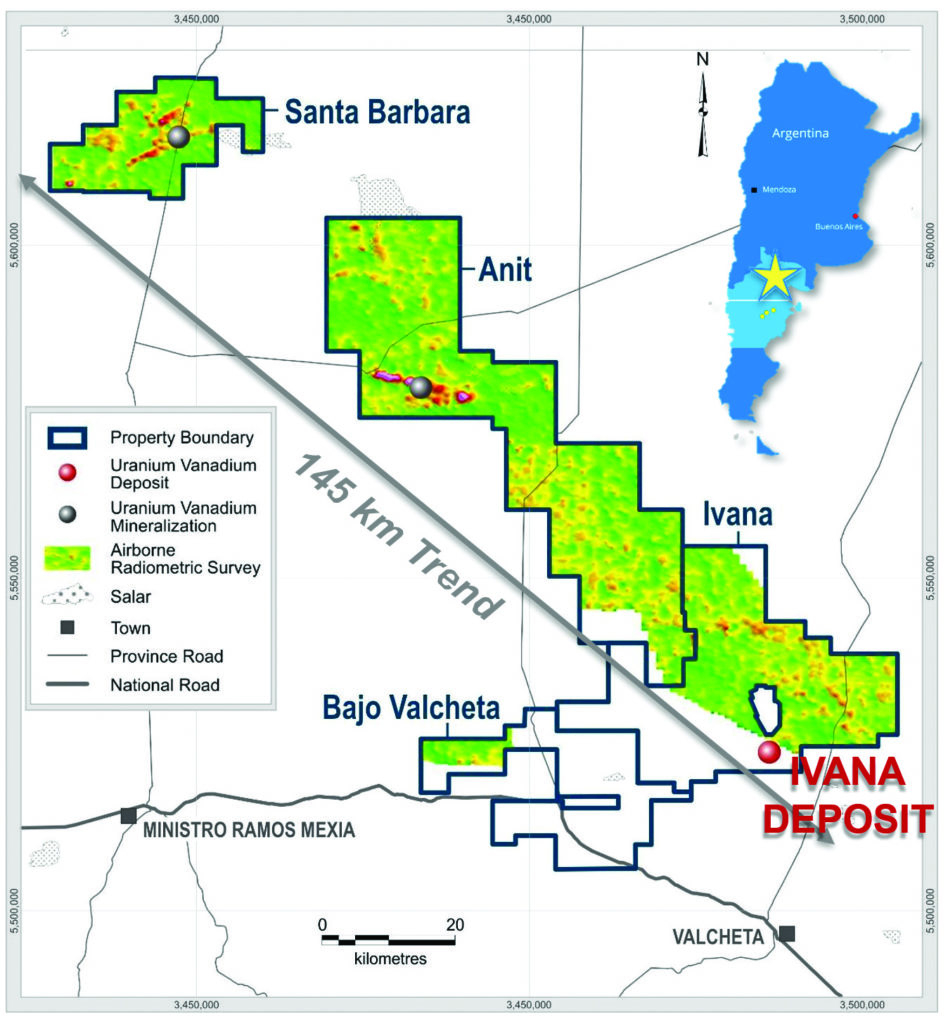

Blue Sky’s flagship project is Amarillo Grande, located about 25 km north of Valcheta City. First discovered in 2007 through ground and airborne radiometric surveys, the company eventually staked out a district-scale geologic trend, 145 by 50 km in size, of both surficial and sandstone-type uranium deposits.

“We did a radiometric airborne study of about 15,000 square kilometres—that is an enormous area, around half the size of Switzerland,” recalls Cacos. “All of a sudden you could see radioactive blobs showing up over huge areas on the map.”

RC rig in action testing one of the exploration targets at the Amarillo Grande Project. Blue Sky Uranium

Since beginning a revitalized work program in 2016, Blue Sky has focused much of its efforts on the Ivana property within Amarillo Grande, which features a prominent radiometric anomaly caused by uranium mineralization at or near the surface. Surface exploration, ground geophysics, pit sampling, and drilling outlined the presence of a curved mineralized corridor, 5 km long, 200 to 500 metres wide and up to 23 metres thick.

In 2019, Blue Sky released a preliminary economic assessment (PEA) for Ivana. The report outlined a 13-year mine life for an open pit operation that would cost US$128 million to build. Annual production was forecast at nearly 1.4 million lb. of uranium oxide (U3O8) annually over the mine life.

The PEA found that for these projections, all-in-sustaining costs could be achieved at uranium prices of US$18 per lb. Assuming a price of US$50 per pound for uranium and US$15 per pound for vanadium, the assessment predicted an after-tax internal rate of return of 29% and a net present value of US$135 million (using an 8% discount rate), with an after-tax payback period of 2.4 years.

The PEA was based on an updated mineral resource estimate for Ivana of 28 million inferred tonnes grading 0.037% U3O8 and 0.019% V2O5 for 22.7 million lb. contained U3O8 and 11.5 million lb. of V2O5

Although uranium contracts do not trade publicly, spot prices have soared since 2019, spiking at US$58 per lb. in March 2022 before settling at close to US$50 for the remainder of the year. Investment research team the Oregon Group predicts the start of a 10-year bull market for uranium in a report dated Nov. 22.

“There’s a recognition that nuclear energy is safe, reliable, and efficient,” Cacos says. “In discussions about clean air and clean energy, uranium is taking centre stage and investors are becoming aware of that.”

To deal with the challenges of delineating resources within a district-scale property, Blue Sky opted for a hub-and-spoke approach to keep capital costs contained. The firm elected to explore four new targets — Ivana North, Ivana Central, Ivana East, and Cateo Cuatro — that all lie within a roughly 30-km radius from the original Ivana deposit. With permits for drilling recently in place, on Sept. 26, the company announced plans to launch a comprehensive field exploration program at Cateo Cuatro to refine drilling targets. In addition, the Ivana East target was slated for advancement to drill-testing stages.

Results from techniques including induced polarization tomography indicated that Blue Sky’s new targets had similar geological characteristics to the environment at the Ivana deposit, located between 10 to 30 metres deep.

“With Cateo Cuatro, we’re quite excited because some of the highest samples in our exploratory program have come from that area,” Cacos states. “We’ve got a team there that’s doing geological work and geophysics trying to identify drill targets. They do some handheld auger drilling too because the mineralization occurs at surface and the ground is unconsolidated, which makes it quite easy to do.”

Cacos emphasizes that one of the keys to the potential profitability of Amarillo Grande is the near-surface character of the uranium deposits. Mineralization at the Ivana property is composed primarily of carnotite, a bright-yellow radioactive material that typically forms tiny grains instead of large crystals. At the Ivana deposit, carnotite is primarily found at or near surface, coating clastic sediments over kilometre scale distances.

“When we first went with our geological team to ground truth our airborne studies, we drove on a lot of gravel roads,” Cacos remembers. “After following a grader for some distance, our team’s Geiger counters immediately went off when we got to our next stop — the car had carnotite stuck right in the fender.”

Kazakhstan, which supplies about 40% of the world’s uranium, also mines carnotite at underground sites, some of which have been in existence for over half a century. One critical aspect of Kazakhstan’s current competitive advantage is an abundance of low-cost recovery techniques such as in-situ leaching, where minerals are recovered by pumping specially treated groundwater through an orebody.

Blue Sky also aims to introduce low-cost uranium recovery at any future test program, but with a made-in-Canada twist. In the proposed setup, a simple wet scrubbing and screening process would wash away about 75% of the mass of an aggregate sample, leaving behind a concentrated mixture of uranium and vanadium. Alkaline leaching of the feed concentrate leads to projected overall process recoveries of 85% for uranium and 53% for vanadium.

“The alkaline leaching process uses sodium bicarbonate, which is cheap and has almost no environmental impact,” Cacos says. “It’s tried and true and was developed at the Saskatchewan Research Council.”

Amarillo Grande property map showing an airborne radiometric survey with anomalous values (yellow/red/purple) along a 145-km-long trend. Blue Sky Uranium

Cacos notes that the Amarillo Grande is a depressed basin within the flatter Patagonia plains, a natural setting that minimizes the risk of spills and leaks. The Blue Sky holdings also benefit from a network of nearby roads, railway, and electrical power thanks to an established oil and gas presence in the region.

A future Amarillo Grande site could help meet Argentina’s power demands, as the country has three nuclear power plants in operation and more in the planning stages. Current Argentine legal frameworks direct nuclear reactors to purchase uranium from domestic suppliers first, but so far, no producers have entered the market.

“Argentina is involved in every facet of the nuclear cycle except for production,” Cacos states. “They import it, and that’s one of the opportunities that’s before us. This is the most advanced and largest uranium deposit in Argentina.”

Forecasts by the World Nuclear Association indicate uranium supply deficits in the coming years unless new mines are brought online. Combined with increased fears about the security of Kazakhstan sources amid the Ukraine-Russia conflict, Cacos foresees 2023 as a year when the company takes a step toward its endgame — finding a partner to advance production for both Argentine consumption and worldwide sales.

“We feel there’s a possibility here, we can upgrade the resource from inferred to indicated so we have a better-quality deposit,” he notes. “In light of higher commodity prices, we might be able to put more shine on this apple.”

“The financing coming in ensures a buffer that will see us through to our next catalyst event,” Cacos continues. Possible catalysts could include the announcement of additional drill results at the Cateo Cuatro and Ivana East targets, and completion of an updated economic assessment. A third would be a move toward a pre-feasibility study, a possibility that Cacos suggests is on the horizon.

“We’re not just another uranium junior explorer,” adds Cacos. “What we have on hand is not just a single deposit, we’ve got the potential to develop an entire new district with potentially 100 or 200 million pounds of uranium. The upside is huge.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Blue Sky Uranium. and produced in co-operation with The Northern Miner. Visit www.blueskyuranium.com for more information.

Be the first to comment on "JV Article: Blue Sky Uranium foresees ‘formative year’ at Argentine site amid global energy crunch"